This paper gives an overview of the prospects for algae production as a source of protein as well as other nutrients including vitamins, beta-carotene and polyunsaturated fatty acids in Europe. The authors examine algae as a source of protein, the current European protein market and challenges and opportunities for production in Europe.

Algae has a role to play in natural ecosystems and has many uses for humans in food, cosmetics and pharmaceuticals. Recently, there has been increasing interest in using algae as a possible substitute for animal protein because of its high protein content and nutrient density. There are two broad classes of algae, macroalgae and microalgae. Commonly grown macroalgaes include red, green, and brown algae (Ochrophyta), with brown algae accounting for the majority of production in Europe. Microalgae are generally grown in open ponds (stagnant shallow water bodies) and generate energy from carbon substrates like glucose. There is also potential to use wastewater and agricultural residues as an energy source for microalgae.

As regards its nutritional benefits, algae offer a source of many vital micronutrients including iron, calcium, vitamin C and B12. They contain high levels of protein when dry and are also low in fat. They are also abundant in a type of fibre which can help regulate blood glucose levels. In terms of their protein content and quality, both arthrospira and chlorella contain high-quality proteins with amino acid profiles that meet the WHO/FAO/UNU standards for the amount and balance of essential amino acids that humans need. In terms of land use algae is the highest performing option for sustainably meeting Europe's dietary protein requirements. Microalgae requires approximately 2.5 m2 of land per kilogram of protein as opposed to 47 - 64 m2 for pork, 42–52 m2 for chicken and 144–258 m2 for beef.

Microalgae’s protein content has also led to rising demands in its use as a food ingredient. Arthrospira platensis (Spirulina) and Chlorella vulgaris are the most popular microalgae species, and they are also sometimes used as vegan protein sources because of their high protein content (50%–60% of dry weight), along with corresponding levels of essential amino acids and vitamin B12 content. Nestlé is in the process of commercialising microalgae in plant-based products , and Unilever are also starting to use microalgae Chlorella vulgaris in their production of plant-based products.

Microalgaes have been hailed as ideal food sources because of their quick growth, nutritional benefits and low environmental footprint. Some terrestrial plants have industrial uses, due to their capacity to gel, absorb water and fat, emulsify, and foam. Microalgae exhibit these same properties, making them both nutritionally and industrially versatile ingredients. The food industry uses algae in a variety of ways, including as a gelling agent, raw food, cooked ingredient, texture enhancer, and vegan egg substitute.Some algaes including nostoc, spirulina and aphanizomenon have also been dietary staples for thousands of years.

Several industries in Europe already utilise inputs derived from algae including the horticultural industry, the food and beverage industry, pharmaceuticals and cosmetics. The extraction of nutrients and dietary supplements from algae is the most common of these. There are currently only a small number of companies producing algae for food in Europe in 2020, but this indicates that there is a significant potential for growth. Spirulina producers are primarily found in France, Italy, Germany and Spain, as shown by Image 1, below. The number of macroalgae food production units is highest in France, Norway, Denmark, Ireland, and Spain, while the number of microalgae food production units is highest in France, Germany, the Netherlands, Spain, and Italy. Concentrations of producers per country can be seen in the Image below. The European algae market exceeded USD 193 million in 2022 and is projected to reach almost USD 300 million by 2027. This demand is primarily driven by increased demand for alternative proteins

Image 1: Total number of companies engaged in production of algae for food.

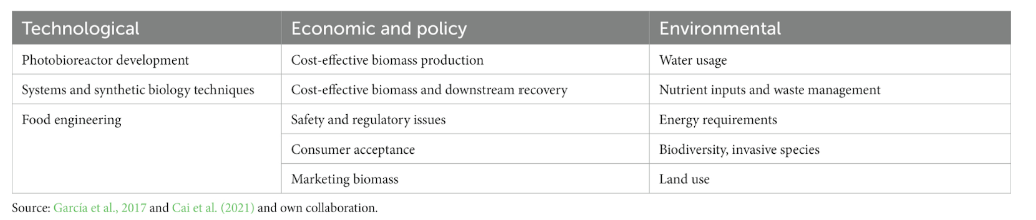

However there are currently technological, economic and policy barriers to increasing the production of algae in europe. Technical barriers include optimising yield, dehydrating algae cultures to produce biomass and biomass pretreatment. In the case of protein extraction specifically, there are technological infeasibility issues at scale due to the infancy of the field. A full list of technological barriers is detailed in the image 2 below. A major regulatory barrier in Europe is food safety standards related to exposure to heavy metals in food, such as mercury, arsenic, lead and cadmium. Many of these pollutants are often present in bodies of water and can be absorbed by algae. Additionally, because of the lack of government regulation of inputs for algae production, there are often significant variations in the end product. Finally, large-scale cultivation of microalgae frequently results in serious problems with biological contamination because contaminants can easily enter the environment through the water algae is grown in.

Image 2: technological barriers to scale the production of algae in Europe.

To encourage the use of algae for production and nutrition throughout Europe, a European algae stakeholder platform, EU4 Algae, was established in 2021. The platform aims to urge EU consumers and businesses to use algae for nutrition and other purposes, and speed up the development of a European algae sector. The platform has produced a collaborative roadmap focused on four pillars: opening up regulatory opportunities, easing access to green investments, assisting with research and development initiatives, and creating joint promotion and communication.

Abstract

The paper aims to examine the prospects of algae production as a source of protein in the European market. As well as highlighting the promising developments in the algae food industry in Europe. By 2027, it is expected that the algae protein market will be worth approximately USD 300 million. We conducted thematic analysis and synthesis of scientific literature and conceptual documents at the European level. The studies reviewed show that the nutritional value of food products can be increased by using algae. The production of algae for food should be encouraged in Europe because it is a viable alternative protein source. To fully utilize algae as a source of protein, however, a number of technological, regulatory, and market-related obstacles must be resolved despite the indicative advantages. Developing cost-effective and efficient methods for algae cultivation, harvesting, and processing are also necessary. Uniform and consistent regulations are needed to guarantee the safety and quality of products that contain algae, as well as consumer awareness campaigns and education about the advantages of algae protein. In addition to providing evidence of the viability of algae production as a source of food, this study demonstrates that algae land needs are negligible compared to other protein sources—animal-based like pork, chicken and beef production but also plant-based alternatives such as nuts, pulses, grains and peas. Furthermore, results in this study may inspire a more targeted focus on algae production as a source of nutrition and inspire more organizations around the world to move ahead with the alternative protein source production from algae.

Reference

Cerveny, J., Prochazka, P., Abrham, J., Soukupová, J., Ouma, C.N., Sanova, P., Smutka, L. and Mullen, K.J. 2023. Algae as a source of protein in the sustainable food and gastronomy industry. Frontiers in Sustainable Food Systems, 7, p.1256473.

Read the article here and for more on seaweed listen to our podcast Sahil Shah on Scaling Seaweed

Comments (0)